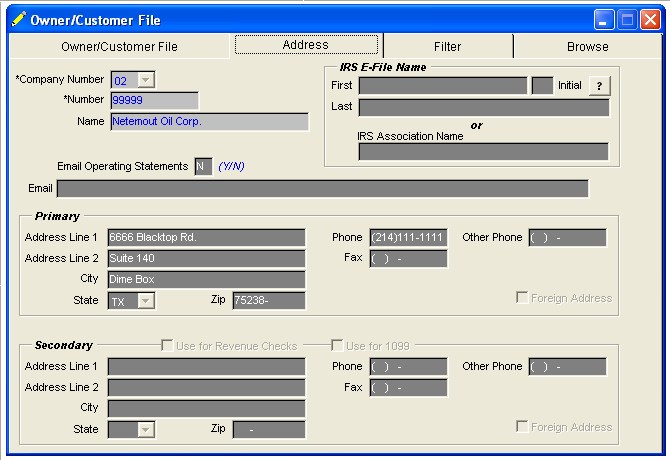

Owner/Customer File

This file contains both Owners and Customers.

Customers are people other than owners, that you can send bills to and track through Accounts Receivable. Owners are Investors (Ex: Charles Richgood). Customers and owners are stored in the same file (CUST.DBF). Customers and owners cannot have the same number, since they are stored in the same file.

TIME SAVER

You can also use the Quick Copy Tool, to quickly copy Owners from One Company to Another.

If you have more than one company and If different companies use the same owner, customer, vendor or employee, you must assign him to each company to track year to date information. Otherwise the year to date values for each company, Government Form 1099, W-2 info, etc..., is not kept properly. Remember, at the end of the year, it is a company that issues 1099's, W-2's, etc... You can use the same code number for the same person in each company, since the addition of the company number will distinguish its index key from the same record in a different company (SMITJ01 vs. SMITJ02). When adding owners, vendors and employees for multiple companies, use the carry-add feature or use the Quick Copy Tool, to quickly copy Owners from One Company to Another.

Select Master - Owner/Customer

To Enter data for the Address, click the Address tab.

The Owner/Customer file stores each owner’s name and address. The owner’s year to date billed amount, minimum check amount, the federal backup, and state-withholding amount are also stored in the Owner/Customer file. If the same owner/customer is used for another company, use the carry add feature after all data has been entered for this company.

Note: Owners that have both Working interest and a Royalty interest must have two different owner numbers. The IRS requires separation of the revenue on 1099 forms at the end of the year.

Note: In order to get all records of a file, the Filter conditions must be blank, otherwise it will only list records that were contained in the previous filter.

NOTES ON FIELDS

COMPANY NUMBER: The company this owner/customer will be assigned to.

OWNER/CUSTOMER NUMBER: Any 5-character code description. May be number or character. If number needs to be changed in the future you should use Key Code Change routine. Roughneck requires 5 characters for the code number for owner, customer, vendor and employee records. A suggested method for using alphabetical characters as code numbers is to use the first 4 characters of the last name plus the first character of the first name, for individuals names. For example, "SMITJ" would be the code number for "John Smith". For company names, try using the first 5 characters of the company name (omitting any periods, spaces, commas, etc...) For example, "ABCCO" for the A.B.C. Co.

Note: Owner Numbers 99990 TO 99999 are Reserved for the Operator Since many times you as the operator will also own a part of each well, you also need to be entered as an owner. Owner numbers 99990 - 99999 are reserved for your company as an owner for expense and revenue interest in a unit. Operating Statements are printed for owner numbers 99990 - 99999, but no revenue check is issued. You may also use this range of numbers for a deleted interest owner who may receive revenue direct from the purchaser.

No journal entries are made to the Transaction file when using this range of owner numbers. No Accounts Receivable invoices are generated for this range of numbers. The Division of Interest file is updated for tracking year to date totals for this range of owners.

OWNER/CUSTOMER: Specify if the person is an owner or a customer. Accounts Receivable can have both owners and customers. 'C'=customer's, 'O'=owner's. This field provides you another filter for your Accounts Receivable reports. Owners are Investors who own an interest in properties (W.I., Royalty, and Override). Customers are people other than interest owners that you may bill for services, such as Phoenix Water Hauling.

NAME: Name of customer or owner. This field is 40 characters. Operating Statements, Revenue Checks, and Accounts Receivable Monthly Statements will reflect the full 40 characters. Some reports will not reflect the full 40 characters due to space limitation. The I.R.S. does not allow enough space on the 1099 forms for 40 characters, you may need to adjust name and address lines for 1099 forms.

IRS REPORTED NAME: If the customer has a different name he/she reports to the IRS then this is where you would input it. Example: John & Jane Doe is in the Name field but, only John wanted to report it then you could enter John Doe in the IRS Report Name field.

FEDERAL ID NUMBER: Federal identification or social security number needed for 1099's.

BILLING TERMS: Net due in number of days. 0=COD, 30=Due in 30 days. This field is used to automatically calculate the date due for Accounts Receivable invoices. For example, if terms = 10, then 10 days are added to the date of the invoice to determine the due date of the invoice.

DIRECT DEPOSIT: This allows you make direct deposits for Revenue Checks, instead of printing a check. A Revenue Check will not print for the Owner when you execute the routine for printing revenue checks. Before printing Revenue checks you will be flagged. "Total checks required = XX" and "Total Direct Deposits required = XX". You can print a register of direct deposits at that time or after you update - using Transations - Check Listing and select "Revenue (DD Only).

HOW TO NETOUT OPERATING STATEMENTS (C/E/N): Netouts refer to subtracting expenses and prior Accounts Receivable balances from revenue. This code determines how to netout this owner when printing Operating Statements. If the netout code in the Owner/Customer file is E, only then will the DOI file be checked for netout.

C = Combine the amount owing on all units into one single balance forward due. Will not check DOI file; the C here overrides the netout code in the DOI file.

E = Each unit has its own balance forward due. Will check the DOI file, if netout code in DOI file is checked, then expenses and prior balance invoices for that unit will be subtracted from revenue on the unit.

N = No netout to be done for this owner. Will not check DOI file; the N here overrides any netout code in the DOI file.

See How to Use NetOut's for more info.

PRINT 1099's: If an owner is not marked ‘Y’, a 1099 form will not be printed for this owner. You may not have a valid address for mailing or he may be a nonresident alien. If year to date federal withhold field or year to date state tax withhold field has amounts, a 1099 will not be printed if owner is marked ‘N’. Performing a 1099 sanity check will check these values and print error messages.

YTD BILLED: Total billed from Accounts Receivable invoices entered and JIB invoices from Operating Statements. Year to date billed is not the amount used for 1099's. 1099 amounts are stored in the DOI file. This field is updated each time an invoice is added to the Accounts Receivable programs.

SPECIFIED MINIMUM CHECK AMOUNT: The specified minimum check amount for each owner is used when Operating Statements are processed. See to How to Use Minimum Check Amounts for more info.

MIN. CHECK WITHHOLD MTD BALANCE: Amount withheld from last update of Operating Statements due to minimum check amount. Used in Operating Statements for minimum check amounts by owner. The minimum withhold month to date amount is replaced each time Operating Statements are updated and current check amount is added to life to date withhold field. Detail of minimum check withhold information is stored in the file WHDINFO.DBF.

MIN. CHECK WITHHOLD LTD BALANCE: Life to date balances in withholding are due to minimum check amounts from Operating Statements. Only when the specified amount of minimum check is reached, or you specify minimum check amount is $0.00, will the minimum check withholding amount be released and life to date values will be cleared. When the life to date withheld amount reaches the specified minimum amount you requested in Operating Statements, the life to date amount is released to the owner and withhold fields are cleared. All minimum life to date balances should be released in December checks. Withhold balance is per owner, not per unit. Filter for Operating Statements allows for releasing withhold balances.

FEDERAL BACKUP WITHHOLDING RATE: If an owner does not supply a Tax ID number, the Operator should backup withhold from revenue, (0=Don't Withhold). Normally the rate is 31% for U.S. citizens that do not have a Tax ID number and 30% for a nonresident alien. If a U.S. citizen provides a Tax ID number or a nonresident alien provides you with an exempt certificate, you no longer withhold revenue. If the owner provides his Tax ID number, or nonresident provides exempt certificate change the backup withhold rate to '0' to stop backup withholding. With Override and royalty owners, backup withholding is calculated on gross revenue (less severance tax). Working interest owners backup withholding is calculated on gross revenue. Refer to your IRS Circular E for backup withholding.

YTD FEDERAL BACKUP WITHHELD: Amount withheld this year for federal backup withholding from revenue for 1099's. If an owner has a backup withhold rate other than '0', this rate will be computed on net revenue for override and royalty owners. Working interest owner's gross revenue will be computed on the rate specified. The Operating Statement will deduct federal backup withhold amount. When Operating Statements are updated, the federal backup withheld amount will be stored in this field. Year to date federal backup withhold amount will print on an owner's 1099 form in box 4. You will be asked during update for Operating Statements to enter the liability general ledger number for federal backup withhold amount. Company total for federal backup withhold amounts may be printed in the JIB program. Refer to your Circular E from IRS for depositing federal backup withheld amounts.

STATE TAX WITHHOLDING: If you need to setup your state tax rate you can select the Tax Setup button and change the tax percentage to your state tax percentage. We have also added a Tax Help button that will read as follows:

WITHHOLD STATE TAX (OTHER STATES)

Some states (i.e. California) have a new state tax withhold rate for owners that are non-residents and receive income. If withhold state tax is checked, the state tax rate will compute tax from gross revenue. If an owner is not checked, no state tax will be withheld.

Amount withheld this year for state tax withholding from Operating Statements and used for 1099's. If withhold state tax is checked, the state tax rate will be used to calculate state tax and deduct from gross revenue. The state tax withheld will be stored in year to date state tax withhold field. The amount in this field is printed in box 16 on the 1099 miscellaneous forms. You will be asked during update for Operating Statements to enter the liability general ledger number for state tax withheld amount. Refer to your state for depositing state tax withheld amounts.

NM (ALL STATES) NON-RESIDENT STATE TAX

SB 621 7-3-12

“The pass-through entity shall deduct and withhold from each non-resident owner’s share of net income an amount equal to the owner’s share of net income multiplied by a rate set by department regulation…”

Any owner not living in the state of New Mexico, receiving revenues on a well located in New Mexico, will be required to pay a non-resident state tax of 6.75% of their net revenue.

(Gross Revenue – Taxes = Net Revenue * non resident tax rate)

OK (ROYALTY) NON-RESIDENT STATE TAX

SB 495 Section 2385.26 A.

"Each remitter, except as otherwise provided in subsection B of this section, shall deduct and withhold from each payment being made to any royalty interest owner in respect to production of oil and gas in this state, but not including that to which the remitter is entitled, an amount equal to six and three-fourths percent (6 3/4%) of the gross amount which would have otherwise been payable to the person entitled to the payment."

Any Royalty Owner not living in the state of Oklahoma, receiving revenues on wells located in Oklahoma will be required to pay a non-resident state tax of 6 3/4% of their gross revenue. If you are withholding the non-resident state tax for the 6 3/4% then you do not withhold the additional 5% on the Pass Through Entity State Tax.

OK PASS THROUGH ENTITY STATE TAX

HB 1356 Section 23

"A pass-through entity shall withhold income tax at the rate of five percent (5%) of the Oklahoma share of income of the entity distributed to each non resident member..."

Any Owner not living in the state of Oklahoma, receiving revenues on wells located in Oklahoma will be required to pay a non-resident state tax of 5% of their gross revenue. This does not apply to Royalty Owners you are already withholding the non-resident tax of 6.75%. Those owners will not need to additionally be charged the 5% withholding.

If you should have any other questions on how the bills work, you will need to contact your state for further detail information. You can visit the Oklahoma Tax Commission website for more information at www.oktax.state.ok.us or call them at (405) 521-3133.

TAX SETUP

This option allows you to setup for the State Tax Withholding rate. Some states require withholding of income tax on certain payments to non-residents.

The tax to be withheld is calculated using the following formula:

(State Tax Withheld amount = Revenue x Withholding rate)

COMMENT: You may enter a 1-line comment for additional information for each owner. EX: Owner is on suspense due to legal dispute. Comments will be printed on the Owner/Customer report.

NOTES ON FIELDS FOR ADDRESS TAB

EMAIL OPERATING STATEMENTS (YES OR NO): If checked ‘Yes’ then under File, Setup Options, Operating Statement Format the option for ‘Email Operating Statements’ must be marked ‘Yes’ in order to send statement for owner. You will be able to email the statements at any time after you print the statements. Refer to the ‘JIB’ section of manual for further information.

EMAIL ADDRESS: Owner/customers email address.

ADDRESS LINE 1 AND 2: First and second line of owner/customer address. 40 characters are available for both lines; some reports will not reflect the complete address due to space limitation.

PHONE/FAX NUMBER: Owner/customer phone and fax number.

OTHER PHONE: Owner/customer mobile, work, pager or home phone number could go here.

SECONDARY ADDRESS: This option will allow you to send Revenue Checks to another address other than your Primary Address. It will also allow you to send your 1099’s to a separate address.

FOREIGN ADDRESS: Clicking on this box allows you to enter the Province, County Code and Post Code.

Related Topics

How to use Minimum Check Amounts ~ How to use NetOut ~ Quick Copy Tool ~ E-File Setup ~ Government Forms

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.